Join our newsletter

Subscribe and stay tuned with the latest tendencies about technology

Pensumo is a fintech backed by Ibercaja that converts daily purchases into micro-contributions to an individual pension plan by cashback, with no cost or minimum contribution commitment for the user.

A unique model in Europe with maximum innovation that allows linking cards from any bank and automatically accumulating in the Pensumo Plan a percentage of each purchase in a vast network of partner stores.

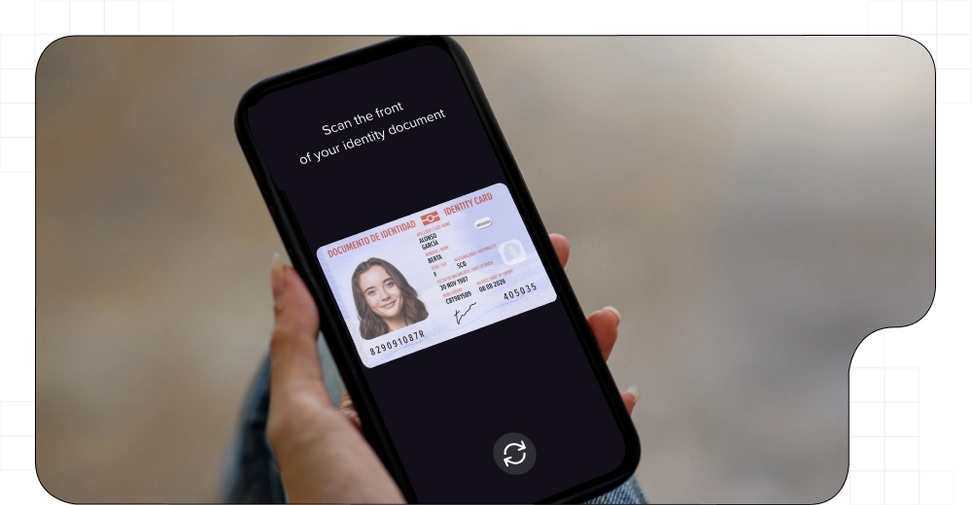

Ensuring a streamlined, simple and 100% digital onboarding process was critical to maximize adoption without sacrificing security or regulatory compliance. The main challenge was to design a comprehensive, unified registration, onboarding and on-boarding system that integrates:

KYC, with data collection, data and documentation verification (ID card, passport, certificates, etc.), advanced AML and AML fraud prevention controls (PEP lists, sanctions, due diligence, BBDD, IP analysis, device, behavior, etc.), eIDAS electronic signature and forms for dynamic scoring.

Tecalis designed a customized solution for Pensumo-Ibercaja based on its well-known SaaS platforms for KYC/AML onboarding, eIDAS e-signature and identity verification.

All the tools and systems required for high financial risk operations were combined into a single, guided, efficient and fully customizable flow adapted to the Pensumo platform at a technical and regulatory level. Highlighting:

Tecalis' modular architecture allows multiple services - from OCR and second-generation AI tools and video-streaming biometrics to more than 40 simultaneous anti-fraud controls - to be natively integrated into a single, scalable platform. The results have been immediate and measurable:

The solution has not only improved acquisition, but has also consolidated Pensumo and Ibercaja's image as innovative, secure fintech companies, ready for exponential growth.