Join our newsletter

Subscribe and stay tuned with the latest tendencies about technology

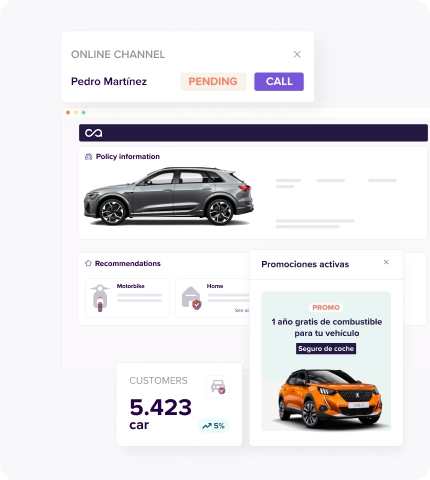

Accelerate policy issuance and claims processing by preventing fraud through your branches, brokers, call centers or online channel.

Talk to an expertClients demand that insurance companies innovate in their processes and services. Diversifying business or processing contracts in just minutes requires a digital, automated, and secure ecosystem.

Equipping agents with a portal that simplifies contracting through guided processes and updated data will enable a positive customer experience.

Protecting customer information and preventing potential fraudulent claims are two key aspects with significant associated costs.

Ensuring compliance with international regulations such as GDPR, eIDAS, AML, or KYC is an increasingly demanding requirement.

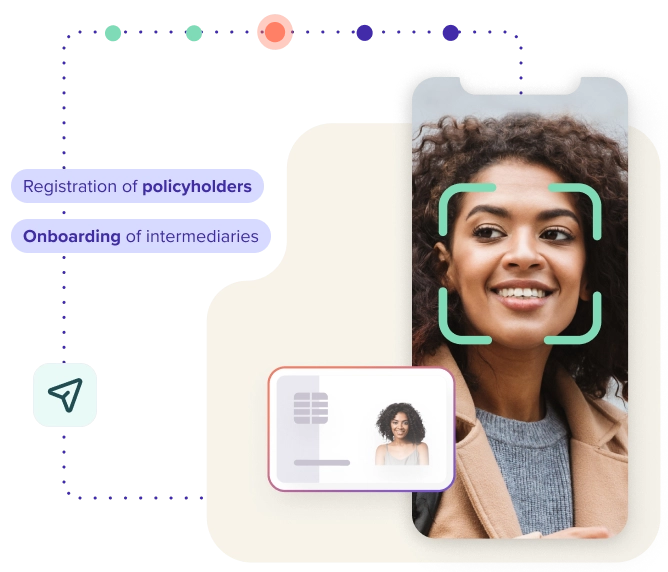

A platform to ensure end-to-end customer or broker registration and onboarding.

Collect and verify the identity information of your insured with OCR technology to mitigate any risk of fraud.

Manage the onboarding of brokers quickly and securely by verifying their identity remotely.

Incorporate new use cases complying with the most demanding KYC, AML, SEPBLAC, RGPD or PSD2/3 requirements.

Increased volume of all types of insurance

In record time and without risk of fraud

Connect your processes with Electronic Signature, Identity Verification and Automation solutions

KYB enables insurance companies to identify potential financial risks by verifying the legitimacy of other businesses and ensure regulatory compliance in the conduct of any activity on an international scale.

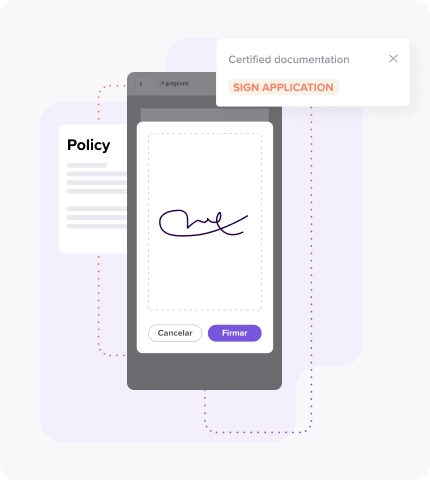

Know moreSpeed up the issuance of policies and contracts signing with a solution that covers the entire process without waiting or lost documents. Provide your customers with complete management of their documents from anywhere.

Know moreErrors in forms management, sending updates or ensuring regulatory compliance can be solved with automation processes, avoiding the loss of customers and other financial damages.

Know moreDiscuss with our experts how Tecalis can help you grow your business