Join our newsletter

Subscribe and stay tuned with the latest tendencies about technology

Complete new registrations, loan applications or online contracts in minutes and ensure regulatory compliance in more than 190 countries.

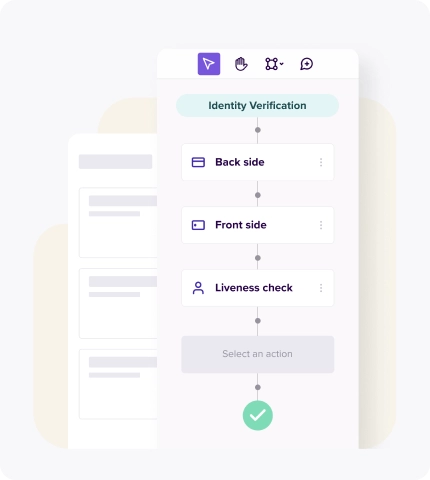

Talk to an expertPreventing identity fraud in customer onboarding, credit card, account opening, or real-time payments is a requirement for banks and financial institutions that should not conflict with other aspects such as operational efficiency or customer experience.

Fulfilling the technical and legal requirements to open a bank account online on any channel or device is now a reality.

As part of PSD2, the SCA allows you to add an extra layer of security to authenticate the user's identity and increase confidence in any online payment.

A RegTech eSignature and identity identification platform with AML controls is a must for scaling any business model.

Seamless experience, regulatory compliance, and high conversion rates.

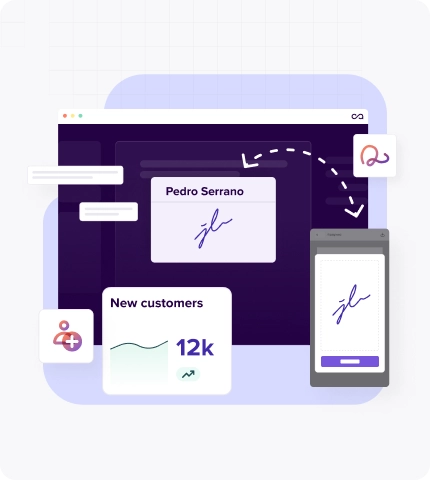

Build workflows tailored to your customer and channel activity while minimizing abandonment rates during the process.

Instantly detect customer data with OCR technology, recognizing the document intelligently and auto-filling fields.

Finalize the process by ensuring conversion within minutes, with the support of a RegTech partner recognized by regulators.

Ensure regulatory compliance with our Electronic Signature, KYB, or Automation solutions.

Connect electronic signature and KYC processes in a single flow and platform to increase engagement rates with a unified experience while gaining superior legal support.

Know moreAutomate daily tasks such as customer verification, payment and loan processing, and reporting, and save up to 75% of time and resources, improving customer satisfaction.

Know moreKYB is an essential tool for banks and financial institutions to evaluate the reputation of companies, partners, and third parties to protect against illicit activities.

Know moreDiscuss with our experts how Tecalis can help you grow your business