Join our newsletter

Subscribe and stay tuned with the latest tendencies about technology

A more affordable, simple and powerful end-to-end tool. Everything you need to work with customers or businesses, users or employees, partners or suppliers.

Tecalis is an affordable end-to-end digital onboarding, scoring, screening and anti-fraud solution that does not miss anything at all. Our commitment to companies in all industries and the fact that it is a proprietary technology solution allows us to offer a truly competitive proposal compared to Onfido. Just ask us for a quotation.

Identity is a global platform covering KYB, KYC, AML, PSD3/SCA authentication and automated scoring processes. At any risk level, you can set up intelligent workflows. All the functionalities expected from the best onboarding solution in addition to all those of Onfido.

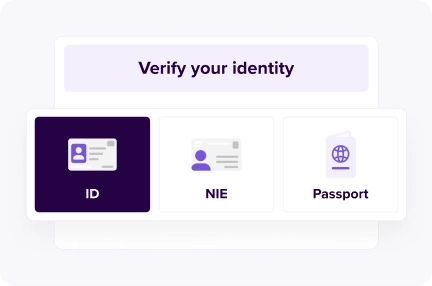

The solution complies with the most demanding standards worldwide, such as eIDAS 2 and AML6 and the rules of the Central Banks of the main states. As an EU QTSP, the RegTech solution is fully legally guaranteed and connected to international listings and adapting itself regarding the region where the operation is being performed.

Tecalis stands out for its top-notch user experience with voiceovers and guides in a perfect UX/UI. We optimize conversion rates to the maximum by establishing intelligent policies and routes. It integrates seamlessly into your systems and applications so that your users trust and complete transactions instantly.

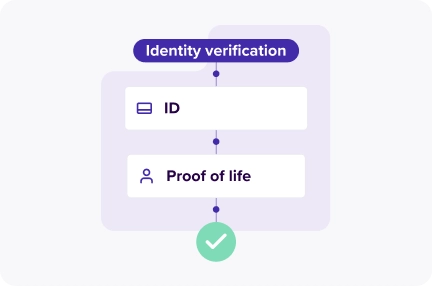

Real-time streaming video identification for unattended, videoconference or 100% unassisted flows with active and passive proof of life, advanced biometrics and the highest quality standards in the industry. The availability of the platform is absolute and you will have teams and resources to help you grow with Tecalis.

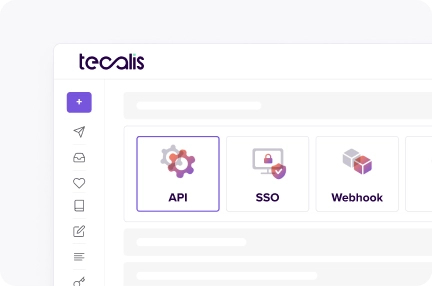

We offer different models of ad-hoc integration made in Tecalis. Whether you already have another solution in place or are integrating for the first time, Tecalis can be up and running on your systems in days without complications thanks to a simple connector and our RPA systems, whether by API, SSO, Webhook or any other model.

Unlike Onfido, Tecalis combines the best of an agile and affordable e-signature solution with the power of custom solution development. Contact our experts to receive a customized competitive proposal and tailor the platform to your needs. 100% adapted to your branding and systems.

All the features and options that have made both small SMEs and large multinationals grow and save. From automated proxy screening to AI screening systems with advanced computer vision, through to NFC, behavioral analysis, IP, hardware, etc.

Unify all your processes in a single platform. Your Customer Journey from start to finish. Easily connect with other Tecalis applications (eSignature, Customer Hub, RPA...) and with your favorite tools thanks to simple integrations. Request a demo now.

More operations in less time, at lower cost. A scalable solution that evolves according to your pace and needs. Change and shape the platform as your business and your customers' needs change. Continuous updating and adaptation to new standards assured.

Tecalis and Onfido are two leading platforms offering advanced solutions in identity verification and anti-fraud controls. Below, we present the distinctive features of each to help users choose the one that best suits their business needs.

Tecalis stands out for its comprehensive (cross-channel) and flexible approach. It supports over 190 countries and complies with regulations such as AML6, eIDAS, and PSD2/SCA. Its advanced features include both active and passive biometric verification, NFC support, and digital certificates. Tecalis also provides KYB validation, address and age verification, and electronic signatures for an end-to-end onboarding process.

One of Tecalis' strengths is its second-generation OCR technology with AI and its bank reading module, which allows for highly accurate form auto-completion and risk scores. Additionally, the platform focuses on providing a frictionless user experience, making onboarding quick and efficient. It also offers multi-factor authentication (MFA) and top-level anti-spoofing controls to operate under any risk level.

Onfido is known for its document verification and facial biometrics technology. It supports a wide range of documents from different countries, similar to Tecalis, and offers flexible API integrations for various business applications. Onfido excels in fraud prevention and process automation, using machine learning to continually improve accuracy and efficiency.

Onfido also provides multi-factor authentication and complies with international security and privacy regulations. Its intuitive user interface and real-time analysis capabilities make implementation straightforward.

Both platforms offer robust and reliable solutions. However, Tecalis stands out for its flexibility and customization capabilities, making it better suited to a wider range of use cases and specific industry needs.

In summary, while Onfido is a solid option, Tecalis offers additional features and greater adaptability, making it the preferred choice for companies seeking a comprehensive and customizable identity verification and authentication solution.

KYB is the acronym for the Know Your Customer process, which consists of confirming that a user who is going to become a customer, employee, supplier, etc. is who he/she claims to be. To do this, a series of questions (KYC Form), anti-fraud controls and documentation and data checks are performed automatically and digitally to enable the registration or purchase operation. It is mandatory in many industries.

KYB is the Know Your Business process: it consists of carrying out a series of controls and checks that must be performed before starting to work with another business, partner, client-company (B2B) or partner. This model automates all the processes carried out in Due Diligence.

Absolutely, Tecalis recommends merging the signature process with the KYC/KYB process. By doing this and Tecalis acting as a unified platform and process, we obtain a double benefit: the greatest possible regulatory support by integrating everything in the same audit trail and the best user experience avoiding abandonment and friction in the process of registering a new user.

Yes, all the functionalities and tools that you can find on our product pages can be integrated independently to streamline and automate any process. Schedule a meeting with a Tecalis expert and we will analyze your activity to propose a solution 100% adapted in price and operational functionalities.

In the vast majority of markets and regions companies are required to perform these controls and use RegTech trust services provided by QTSPs in order to operate. Standards such as AML6, eIDAS 2 or PSD3 in addition to the requirements imposed by regulators such as SEPBLAC, OFAC or other counterpart bodies demand to perform these Due Diligence procedures on the users you work with.

In addition, having these systems in place will allow you to operate easily, without large investments and without a presence in +500M markets such as Europe by simply integrating agile and affordable technologies into your digital onboarding processes. On the other hand, you will mitigate any risk and fraud attempts before they occur and increase productivity and streamline the work of previously inefficient or costly teams.

These tools are technology platforms designed to automate identity verification and regulatory compliance. They use advanced technologies such as optical character recognition (OCR) and computer vision to extract and validate information from identity documents or directly from the web and generate reports. They incorporate biometrics, such as facial recognition, to compare document images with selfies in real time, ensuring that the user is who they say they are.

In addition, they integrate data analysis and machine learning to assess the risk of customers and companies, identifying suspicious patterns and anomalies. These tools connect to global databases and public registries to verify the legal existence of companies, clients and the authenticity of documents presented or connect with banks, among many other functionalities and options.

*Comparative information between the two solutions - especially the comparison table and the informative text - is based on information available on Onfido website and a comprehensive in-house analysis of Tecalis solutions.

Discuss with our experts how Tecalis can help you grow your business