Index

Get the latest news right in your inbox

To operate legally and build trust in the digital age, every organization must master one key element: the KYC (Know Your Customer) form. This dynamic document is essential for ensuring integrity, transparency, and security in commercial relationships in sectors such as banking, fintech, cryptocurrencies, and insurance. Managing customer identity is no longer just a best practice, but a legal obligation.

But how does a KYC form differ from a mere form? Why has its comprehensive automation become critical for regulatory compliance (KYC/AML)?

This article breaks down the concept in technical detail: we explore its legal basis, show how to automate its creation and management with technologies such as those from Tecalis, and reveal the strategic and operational benefits of effective implementation.

What Is The KYC Form and Why Is It Important?

The KYC file is a structured, centralized record that brings together essential, verified information about a customer with whom a company establishes a business relationship. It is not just a set of data, but a validated, up-to-date, and traceable identity profile that serves as the basis for operational security, financial integrity, and customer trust.

In practice, the KYC file is a dynamic digital asset, not a physical document. It is updated throughout the customer lifecycle and includes:

- Basic personal or corporate data.

- Risk profile (low, medium, high).

- Economic activity and sources of funds.

- Ultimate beneficial ownership (UBO) structure.

- Record of prior checks (OCR, biometrics, sanction lists).

Its relevance is critical: without a complete and valid KYC file, a company cannot demonstrate to regulators that it has applied the due diligence required by law. In cases of non-compliance with AML regulations, having a weak KYC file can result in millions of dollars in fines and serious reputational damage.

What Is a KYC Form Used For?

The KYC form serves multiple strategic and compliance functions, as it allows for the identification and validation of customers, the assessment of operational and regulatory risks, and the assurance of transparency in commercial relationships in accordance with current regulations. These are:

- Prevent fraud and money laundering: It allows the identification of individuals or entities with high-risk profiles linked to illegal activities or sanctioned by international organizations.

- Compliance with rules and regulations: This is the basis for compliance with Directive (EU) 2018/843 (AMLD5) and its transposition into Spanish law in Law 10/2010 of April 28 on the prevention of money laundering and terrorist financing. It also applies through Regulation (EU) 2021/821 and subsequent updates (AMLD6).

- Build customer trust: A well-designed KYC process not only protects the company, but also conveys professionalism, security, and transparency to the customer. In sectors such as digital banking or fintech services, KYC onboarding is the user's first experience with the brand.

- Manage operational risk: the KYC file facilitates customer segmentation by risk level (low, medium, high) and allows enhanced measures (Enhanced Due Diligence) to be applied when necessary.

- Ensure traceability and auditing: Every action related to customer identification or verification is recorded, facilitating internal and external audits and demonstrating diligence in the event of an inspection.

Differences Between KYC Form, KYC Document, and KYC File

These terms are often used interchangeably, but each has a distinct role within the KYC process:

- KYC form: This is the data capture tool. It can be physical or digital and is used to collect initial customer information (name, ID, address, profession, source of funds, etc.). In digital environments, KYC forms are often integrated into onboarding flows with dynamic fields that adapt to the type of customer. Their function is to collect declared data.

- KYC document: Physical or digital evidence provided by the customer to validate the information declared on the form. This includes identity documents (ID card, passport, driver's license), proof of address (utility bills, bank statements), company incorporation documents (deeds, tax identification number) and, in some cases, documents proving the origin of funds. Its function is to provide evidence.

- KYC file: This is the final result of the process. It is the master, structured repository that consolidates, verifies, and links all the information. A structured digital profile containing verified customer information, their risk level, attached documents, biometric verification records, and any other relevant evidence. It is stored in a compliance management system and updated periodically.

In summary: the form collects the data, the documents support it, and the file integrates it into a verified and manageable profile.

Legal Basis For the KYC Process: KYC and AML Regulations

The regulatory framework that requires the implementation of KYC processes in Spain and throughout the European Union originates from:

- Law 10/2010, of April 28, on the prevention of money laundering and terrorist financing (LPBC): Establishes the obligation to identify and verify customers (Art. 10), assess risks, store information (for five years after the end of the business relationship), and train staff.

- Royal Decree 304/2014, approving the Regulations implementing Law 10/2010: Details the technical identification requirements, due diligence levels (simplified, normal, enhanced), and cases requiring reporting to SEPBLAC (Executive Office for the Prevention of Money Laundering and Tax Offenses).

- Directive (EU) 2018/843 (AMLD5) and AMLD6: These require Member States to extend the scope of KYC to new sectors (such as electronic wallet service providers and cryptocurrency exchanges) and to strengthen electronic identity verification.

- eIDAS Regulation (910/2014): Regulates electronic signature levels and secure electronic identification, allowing the use of digital means to comply with KYC obligations, provided they meet sufficient technical guarantees.

These regulations impose an obligation of result, not of means: companies must ensure that they have correctly identified their customer, regardless of the channel (in person or digital) through which the transaction was carried out.

Failure to comply with KYC/AML regulations carries very serious administrative penalties, which can amount to millions of euros or 5% of the company's annual turnover. In addition, there are criminal penalties for de facto or de jure administrators, which can even include prison sentences in serious cases.

How To Automate KYC File Creation and Management: a Step-By-Step Guide

Automating the KYC process is no longer an option, but a competitive necessity. Modern solutions, such as Tecalis Identity, make it possible to transform a process that traditionally took days (or even weeks) into one that can be completed in minutes, with greater accuracy and traceability.

Below, we explain step by step how to implement an automated KYC file management system:

1. Secure digital capture

- The customer accesses a link or widget integrated into the company's website or app.

- Complete a digital KYC form optimized for usability and conversion.

- Upload photos or scans of your identity documents and proof of address directly from your device.

2. Document verification

- In seconds, advanced OCR technology automatically extracts data from the document (MRZ, visual fields).

- At the same time, document fraud detection algorithms analyze hundreds of security features: holograms, microprinting, fonts, data consistency, UV and IR patterns. It determines whether the document is authentic, altered, or fraudulent.

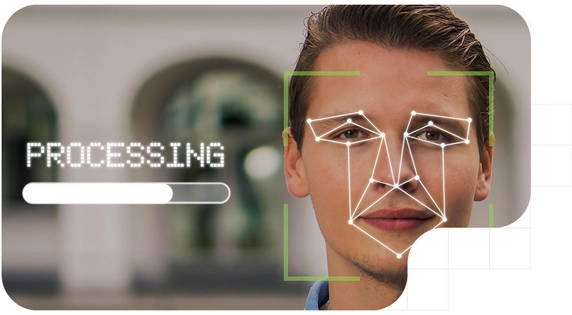

3. Biometric verification and facial comparison

- To comply with the “live verification” requirement, the solution asks the customer for a selfie or a short video.

- A facial biometrics engine extracts features and compares them, using AI algorithms, with the photo on the ID document. This ensures that the person presenting the document is its legitimate owner, combating identity theft.

4. Consent and binding electronic signature

- For high-value transactions, contracts, or when a maximum level of evidence is required, the workflow can incorporate a qualified electronic signature step.

- At this point, the customer digitally signs their explicit consent to the KYC process and the processing of their data. This signature is fully legally valid under the eIDAS regulation, equivalent to a handwritten signature, creating an audited and unchallengeable record of their authorization.

5. Data verification and sanction lists

- The extracted data (name, date of birth) is automatically cross-referenced with reliable databases (official lists, government databases) and searches are performed on PEP (Politically Exposed Persons) lists, sanctions lists, and watch lists (such as those of the UN, EU, and OFAC) for an initial risk assessment.

6. Automatic creation of the KYC file

- This is the core of the automated process. All verified information, such as form data, document authenticity results, facial similarity scores, or list results, is automatically consolidated into a unified, structured, and ready-to-use digital KYC file.

- This file, readable by both humans (interface for the analyst) and machines (API, integration), is stored securely and, critically, automatically linked to the customer's profile in the company's CRM or ERP system.

- This transforms the isolated file into the heart of the verified customer data, accessible to all relevant departments.

7. Workflow and decision

- According to preconfigured rules (for example, if the document is valid, the facial comparison exceeds 95%, and there are no alerts on lists, the customer is automatically approved), the system automatically decides whether the customer is approved, rejected, or sent for manual review.

- Cases that require Enhanced Due Diligence or show anomalies are sent to a compliance analyst's queue, who has all the information consolidated on a single screen.

8. Secure archiving and auditing

- The final KYC file, with all documents and metadata, is stored in encrypted form and with evidentiary integrity, complying with legal retention periods (generally 10 years).

- A complete audit log of all actions performed is generated, which is essential for regulatory inspections..

9. Continuous monitoring

- Advanced solutions offer proactive monitoring services that automatically alert you if a customer subsequently appears on a sanctions list or if changes in their risk profile are detected.

- This allows for dynamic updating of the KYC file, maintaining its validity and usefulness throughout the entire customer relationship.

Technical Requirements For a KYC Verification Solution

For a KYC solution to be valid before regulators, it must meet certain minimum technical requirements:

- OCR (Optical Character Recognition): accurate data extraction from ID cards (DNI/NIE) and passports, even under low-quality conditions.

- Document tampering detection: use of digital forensic techniques to identify forgeries.

- 3D biometrics with liveness detection: The algorithm must be able to perform an accurate “face match” between a live selfie/video and the document photo, even with different angles, lighting conditions, or the passage of time. It must include liveness detection (verifying that the subject is a real person and not a photograph or mask) using techniques such as blink detection, head movement tracking, or micro-texture analysis.

- Certified facial comparison: algorithms with error rates below 0.1% (according to NIST standards).

- Advanced or qualified electronic signature: The solution must be able to integrate the issuance of a qualified electronic signature certificate, granting the signed document the highest legal validity, equivalent to a handwritten signature under the eIDAS regulation.

- Audit trail: immutable recording of all actions (who, when, and how verification was performed).

- Specific regulatory compliance: The platform and its data providers must comply with GDPR in Europe, eIDAS, local data protection regulations (LOPDGDD in Spain), and other relevant frameworks, ensuring the legality of all data processing.

Tecalis meets all these requirements and has been audited by Spanish and European supervisory authorities.

How To Integrate KYC Into Your Business Processes

The true effectiveness of automated KYC lies in its integration with corporate systems. It’s not just about speeding up verification, but about turning it into a dynamic, actionable component within the organization’s digital ecosystem. These include:

- Digital Onboarding Platforms: Direct integration into the website or mobile app for a seamless registration. The form and verification are part of the first interaction, reducing friction and drop-offs. For banks, neobanks, insurance companies, or fintechs, KYC is the first step of the funnel.

- CRM Systems (Salesforce, HubSpot, Microsoft Dynamics): The KYC record is linked to the customer profile, enabling risk-based segmentation.

- ERP and Management Systems (SAP, Oracle): Financial transactions are blocked if the customer has not completed KYC.

- Document Management Tools: KYC documents are stored in secure repositories with access controls. This ensures the process maintains the highest level of legal security.

- Real-Time Verification APIs: They allow KYC verification to be integrated at any point of the customer journey (mobile app, website, chatbot).

- Compliance Platforms: The KYC verification solution can serve as the first link in a broader platform that also handles ongoing monitoring, regulatory reporting, and alert case management.

Integration is typically done via RESTful API, with response times under 5 seconds in 95% of cases.

Benefits of Automating the KYC Process

Beyond regulatory compliance, automated KYC has become a key asset for digital organizations. Automating it not only reduces legal risks but also creates operational and commercial value:

- Reduction of onboarding time from days to minutes. Manual processes involving emails, printing, scanning, and visual verifications can extend onboarding to 3–10 business days. With an automated workflow, users can complete everything from their mobile device in under 5 minutes.

- Higher Conversion Rates: Long, manual forms lead to drop-offs. A smooth digital process can boost conversion by up to 40% (according to McKinsey reports). Instant approval for low-risk cases can increase final conversion by more than 70%.

- Elimination of Manual Errors: Advanced OCR removes data transcription errors from documents. Fraud detection algorithms are far more accurate and consistent than the human eye at spotting sophisticated forgeries. Digitization reduces data capture errors by up to 90%.

- Scalability: You can handle thousands of verifications simultaneously without increasing staff.

- Adaptation to Regulatory Changes: Cloud platforms automatically update to comply with new legal requirements (such as the inclusion of crypto assets in AMLD5).

- Improved Customer Experience: Users appreciate speed, security, and a paperless process.

- Cost Savings: According to Deloitte, companies that automate KYC reduce compliance operational costs by 50–70%.

- More Effective and Early Fraud Detection: Automated systems use artificial intelligence and machine learning that learn from global fraud patterns. They can detect cutting-edge document forgeries and identity spoofing attacks that would go unnoticed in manual reviews.

Frequently Asked Questions about the KYC Form

What does a "KYC document" include?

The term “KYC document” usually refers to the set of documentary evidence that a customer provides to verify their identity and financial status. This can include:

- For individuals: An official photo ID (DNI, NIE, or passport) and a recent proof of address (≤ 3 months) in their name, such as a utility bill (electricity or water) or a recent certificate of residence.

- For legal entities: Certificate of incorporation and updated corporate bylaws; identity documents of directors and ultimate beneficial owners (UBOs) with >25% ownership; proof of the company’s registered tax address; and company tax identification number (CIF/NIF).

- In Enhanced Due Diligence (EDD): Supporting documents proving the source of funds may be added (income tax return, pay slips, sales contract, etc.), especially for high-value transactions.

These documents are scanned, validated, and stored as part of the KYC file, rather than as a single “document.”

Is a KYC File Mandatory For All Companies?

The KYC file is not mandatory for all companies. The requirement applies to obligated entities under Law 10/2010, which include:

- Financial institutions (banks, savings banks, neobanks).

- Securities firms and fund management companies.

- Insurance companies and brokerages.

- Auditors, accountants, and tax advisors (for certain activities).

- Notaries and registrars.

- Art and high-value good dealers.

- Electronic wallet service providers and cryptocurrency exchanges.

- Casinos and online betting platforms.

SMEs or self-employed individuals not operating in these sectors are not obligated, although it is still recommended to implement basic identification controls in high-risk contexts.

How To Ensure The Security of KYC Data?

Protecting sensitive information is a critical element in KYC processes, as it involves handling personal and financial data. To achieve this, it is essential to implement technical and organizational measures such as:

- Use providers certified in ISO 27001 and compliant with GDPR.

- Ensure that data is encrypted end-to-end.

- Implement role-based access controls.

- Store data in the EU (avoid servers in third countries without adequacy).

- Conduct regular cybersecurity audits.

- Apply the principle of data minimization: collect only what is strictly necessary.