Index

Get the latest news right in your inbox

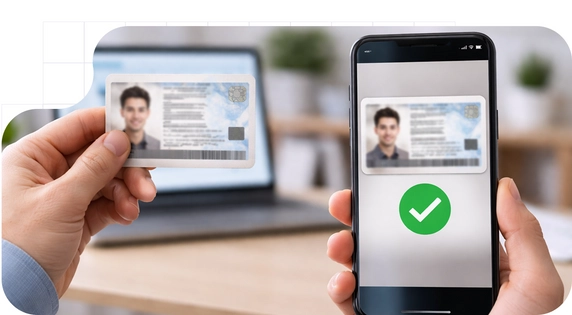

Security and trust are essential in any transaction, whether online or in person. That is why validating an identity document has become a key requirement for companies and public bodies. Nowadays, verifying that a person is who they say they are is no longer an option: it is a regulatory, technical, and ethical requirement. Sectors such as banking, telecommunications, insurance, gaming, and public administrations need to confirm the real identity of their users to comply with the law, prevent fraud, and protect their processes.

This article details what this verification consists of, what technologies make it possible, what documents must be checked, which sectors are required to do so, and how solutions such as Tecalis Identity allow the entire process to be automated with precision, speed, and full regulatory compliance.

What does it mean to validate an identity document?

Validating an identity document is a technical and regulated process designed to guarantee the authenticity of the document and the real identity of the person presenting it. To do this, it is first verified that the document has been legally issued by a competent authority and then analyzed to see if it has been altered, falsified, reused, or reported as stolen. It is confirmed that it is still valid and has not been revoked.

- The document is verified as belonging to its holder by comparing biometric information or documentary data.

- Integrated security features such as holograms, variable optical marks, chips, NFC, or MRZ strips are examined to confirm that they are authentic and operational.

This process can be carried out in person or digitally, depending on the onboarding model adopted.

Why is it so important to verify identity validation?

Identity verification guarantees security, prevents fraud, complies with regulations, and ensures the authenticity of documents to protect transactions and build trust. Therefore, it is key to:

- Prevent fraud and comply with regulations: Mitigate millions in losses from impersonation and ensure compliance with KYC and AML regulations required in critical sectors.

- Reduce risks and secure operations: Legal and operational risks are minimized, ensuring the integrity of digital systems and the legal validity of transactions.

- Regulatory compliance: Regulations such as AML and KYC require entities to verify the identity of their customers before establishing a business relationship.

- Optimize efficiency and experience: Streamline processes such as digital onboarding, offering fast and seamless verification that improves end-user satisfaction.

- Build trust and reputation: Robust validation protects the brand, prevents abuse, and projects an image of reliability and security to customers and partners.

- Ensuring the integrity of digital systems: Especially in sovereign identity or eID environments.

- Experience and efficiency: with automated systems, validation is quick and seamless, without travel or long waits, streamlining onboarding, account opening, and subscriptions.

In identity verification processes, the absence of rigorous validation allows seemingly legitimate documents to be used for fraud and identity theft.

Types of documentation that require validation

Some of the most common documents that require validation include those used to officially verify a person's identity in digital and in-person processes. The most common are:

- National Identity Document (DNI) – Spain and other countries with similar formats.

- Passports – especially biometric ones with NFC chips.

- Residence cards or residence permits: Essential for foreigners undergoing immigration or regularization processes.

- Driver's licenses – increasingly used as an alternative form of identification.

- Foreign identity cards (TIE in Spain, NIE for non-residents).

- Diplomatic or refugee documents, in specific contexts.

- Chip-enabled documents (e-passports, e-ID cards with NFC/RFID)

- Official digital identifications (eIDs) issued by competent authorities.

Depending on the country or sector, other accreditation documents may also be required, such as residence cards, visas, temporary permits, citizenship documents, and other types of identity accreditation.

These documents must be validated not only for their content, but also for their format, materials, and integrated security mechanisms.

Sectors where it is mandatory to verify an identity document

Identity verification is becoming critical in multiple sectors, especially when there are fraud prevention rules, customer identification requirements, or financial regulations. Some of the most relevant sectors are:

- Banking and finance: required by the AML Directive (especially AML5 and AML6) and the KYC framework.

- Insurance: to prevent fraud in contracts and claims.

- Fintech and crypto assets: cryptocurrency platforms must verify identities in accordance with regulations such as MiCA in Europe.

- Online gaming: regulated by national regulations such as the DGOJ in Spain.

- Telecommunications: to prevent fraudulent mobile line contracts.

- Sharing economy: vehicle or home rentals, marketplaces, and digital platforms.

- Public administrations: digital procedures that require strong identification, such as issuing certificates or applying for grants.

- Human Resources and employment: employee onboarding processes, teleworking, and employee recruitment.

- Legal and notarial sector: when certainty of identity is required for signatures, powers of attorney, and legally valid contracts.

- High-value e-commerce: to prevent fraud in purchases made with stolen cards or fake accounts.

In all these cases, validation must be audited, traceable, and compliant with international standards.

How to verify an identity document: methods and technologies

Modern identity document verification relies on a combination of advanced technologies that enable secure, fast, and scalable authentication. The fundamental technological pillars are detailed below:

OCR to extract data from the document

Optical Character Recognition (OCR) is the first step in verification. This technology allows textual data such as name, identification number, or date of birth to be automatically extracted from the document and compared with the information provided by the user. However, OCR alone does not guarantee the authenticity of the document; its function is limited to transcribing data. For this reason, it must be combined with other validation and verification techniques.

Modern OCRs include:

- Automatic document type detection.

- Perspective correction and lighting enhancement.

- Multilingual and multi-zone reader (capable of reading MRZ, barcodes, and NFC chips).

Facial biometrics to confirm the holder

Facial biometrics is the standard for linking a document to its holder. The process includes capturing a live selfie with liveness detection to prevent photos or masks. A biometric comparison is then performed against the photo on the document, using high-precision algorithms. Spoofing is also detected through micro-expressions, blinking, or depth analysis. This step ensures high levels of security and complies with eIDAS standards.

Analysis of security elements and integrity checks

To confirm the authenticity of the document, advanced solutions verify holograms, microtext, MRZ bands, NFC/RFID chips, digital signatures, stamps, or watermarks. In addition, the image is checked for manipulation by evaluating metadata, cropping, or photocopying, which helps detect forgeries and ensure authenticity.

Cross-referencing with official databases and lists

In some cases, verification goes beyond the document itself: platforms consult government databases or official lists, including identity records, ID cards, issued passports, validity, status, blacklists, sanctions, or PEPs. This allows them to confirm that the document is still valid, has not been revoked or reported as stolen or lost, and that the person does not appear on any risk lists.

Hybrid approach: AI + human review

Modern verification combines AI for automation (OCR, biometrics, anomaly detection) with specialized human review in borderline cases. This balances efficiency, automation, and accuracy. The hybrid approach is key to complying with strict regulations (KYC/AML), legally valid electronic signatures, and high-level validations, such as those required by financial institutions or official procedures.

Step by step: how the document verification process works

A typical online identity verification flow includes the following steps, designed to confirm the authenticity of documents and the user's real identity. This process combines automated technologies, biometrics, and security checks to reduce fraud and comply with regulatory requirements.

- Document capture: the user uploads photos of the front and back (or scans the NFC chip if the device allows it).

- Automatic data extraction (OCR): the data in the document is read and structured: name, number, date of birth, date of issue and expiration, nationality, etc.

- Authenticity analysis: The system analyzes security features (holograms, typography, NFC/RFID chip, format consistency, possible image manipulation, photo metadata, etc.) to detect counterfeits, photocopies, manipulations, or attempts at fraud.

- Biometric verification: The user takes a selfie or video, and the system compares the facial image with the photo on the document. It includes a liveness check (movements, blinking, angle change) to ensure that the person is actually present.

- Validation against official sources: validity is verified and data is cross-checked with compliance databases.

- Manual review when necessary: In hybrid models, if the AI does not reach a sufficient level of confidence, a human operator reviews the case and decides whether to approve or reject the verification.

- Evidence generation/recording: The system generates a verification report—with metadata, time, IP, traceability, results of all checks—that can serve as legal or documentary evidence in the event of audits, disputes, regulations, etc.

- Verification result: The system returns a result (approved/rejected), along with the reason if rejected, and allows you to continue with onboarding, signing, contract, and access only if the verification has been successful.

This entire process can be completed in less than 60 seconds with over 99% accuracy. In addition, it offers a level of security that is as high as or higher than in-person verification.

Identity verification software: key features and functionalities

In the digital age, manual document validation is slow and costly, which is why regulated and unregulated companies are adopting identity verification software or KYC/AML solutions that automate the process using AI, cryptography, official databases, and international standards.

High-performance software must include advanced technical and functional capabilities that ensure security, accuracy, and scalability. These are:

- Document capture: ID card, passport, residence permit, or eID via camera, cell phone, or webcam.

- Advanced OCR: automatic data extraction, including MRZ, non-Latin alphabets, and different formats.

- Verification of authenticity and integrity: analysis of security features, detection of tampering, NFC/RFID chip, metadata, digital signatures, structural consistency.

- Biometric/facial verification: with liveness detection to ensure that the cardholder is present.

- Hybrid approach: combining AI and human review to maximize accuracy and reliability.

- Flexible integration: via API, SDK, web, mobile—ideal for digital onboarding and internal processes.

- Scalability: the ability to process large volumes of identifications without losing accuracy or speed.

- Generation of documentary evidence and traceability: logs, metadata, and audits that facilitate regulatory compliance, legal defense, and official reviews.

With these features, companies can offer fast, secure, and reliable verification, reducing fraud risks and optimizing the digital experience for their users.

What to consider when purchasing KYC software

When evaluating a digital identity verification solution, it is essential to consider the following aspects. These determine its ability to operate securely, efficiently, and in compliance with current regulations:

- Global coverage: Support for over 10,000 document types from more than 200 countries.

- Compliance: ISO 27001, GDPR, eIDAS certifications, etc.

- Accuracy: False positive and false negative rates below 1%.

- Speed: Processing times < 30 seconds.

- UX/Interface: Frictionless mobile and web processes with high conversion rates.

- Multi-channel support: SDK for mobile apps, web widgets, REST APIs.

When choosing KYC software, verify compatibility with documents, formats, and countries. Ensure that it complies with local regulations and standards such as KYC, AML/PLD, GDPR, and eIDAS 2.0. Confirm the availability of technical support and international certifications for greater reliability.

Automation, precision, and regulatory compliance

To ensure agile, accurate, and sustainable compliance in an ever-evolving regulatory environment, effective KYC software must:

- Automate real-time decisions based on risk rules: reduce human error, speed up onboarding, and immediately block suspicious transactions.

- Automatically update with regulatory changes (e.g., new AML lists): ensures that the company always complies with current legislation without the need for constant manual reviews.

- Provide auditable logs to demonstrate compliance to supervisors: facilitates regulatory inspections and provides transparency and traceability in all verifications performed.

API integration and digital onboarding optimization

To facilitate a smooth user experience and frictionless compliance, most modern software offers RESTful APIs that allow verification to be integrated into:

- Mobile apps (iOS/Android): allow identity verification to be integrated directly into the end-user experience, ensuring fast and secure onboarding.

- Websites (JavaScript, React, Angular): facilitate KYC implementation on online platforms, offering intuitive interfaces and multi-platform compatibility.

- Backend flows (Java, Python, Node.js): enable the automation of verification processes, efficiently integrating KYC software into the company's infrastructure.

This allows companies to design 100% digital onboarding processes, without human intervention, and with high levels of security.

Beyond the identity document: verification of other documents

Advanced KYC systems are no longer limited to ID cards or passports. Thanks to artificial intelligence and specialized OCR, they can verify:

- Notarial powers: verification of signatures, seals, and notary authenticity using OCR and notarial databases.

- Digital certificates: validation of qualified electronic signatures (eIDAS) and certificate expiration.

- Digital identity wallets: integration with systems such as the European Digital Identity Wallet (EUDI Wallet), which will allow citizens to share verified attributes without revealing their entire identity.

- Property records: validation of title deeds, deeds, or cadastral certificates in real estate transactions.

- Invoices and receipts: to verify tax residence or actual address (common in bank onboarding processes).

- Academic documents: verification of university degrees using digital stamps or educational blockchains.

These capabilities transform KYC from a regulatory requirement into a strategic tool for digitizing complex processes. All of this is processed automatically, reducing the operational burden and speeding up validation times.

Adaptation to local and international regulations

Regulations surrounding digital identity are evolving rapidly. Any verification solution must anticipate these changes:

- eIDAS 2 (European Digital Identity Regulation): establishes a common framework for digital identity in the EU, including the EUDI Wallet. It requires identity verification processes to reach at least the substantial level (and high for sensitive financial or administrative transactions).

- PSD3 (Payment Services Directive 3): will strengthen strong customer authentication (SCA) requirements and demand more rigorous identity verification for recurring payments and new customer onboarding.

- AML6 (Sixth Anti-Money Laundering Directive): tightens due diligence obligations, requiring more thorough verification in digital environments and penalizing corporate negligence.

- GDPR and LOPD-GDD: regulate the processing of biometric and personal data, requiring minimization, encryption, and the right to be forgotten.

- MiCA (Markets in Crypto-Assets Regulation): requires crypto-asset service providers to implement KYC processes equivalent to those in the traditional financial sector.

Identity verification software must be designed to adapt dynamically to these frameworks, not only complying today, but anticipating future requirements.

Tecalis Identity: KYC/AML identity validation and verification software

Within the market for advanced identity verification solutions, Tecalis Identity has established itself as a leading platform in highly regulated environments, thanks to its combination of automation, accuracy, regulatory compliance, and integration capabilities. It is designed for companies that require robust, auditable, and scalable verification flows, with a particular focus on the financial, telecommunications, insurance, public administration, marketplace, and digital platform sectors.

Key features

In a demanding regulatory environment with increasingly digital users, the technical and compliance capabilities of a KYC solution make all the difference. The most important ones are:

- Multi-channel validation: supports physical, digital, and NFC documents from over 200 countries.

- NFC reading: Compatible with DNIe 3.0, biometric passports, and European eIDs.

- Biometrics with 3D liveness: advanced spoofing detection through depth and motion analysis.

- Real-time verification against official sources: includes direct connection to the Spanish ID verification system, among others.

- Integrated KYC/AML engine: automatic screening against sanctions lists, PEPs, and risk databases.

- Certifications: Compliant with ISO 27001, eIDAS high level, and currently undergoing ICAO and BSI certification.

- Flexible deployment: cloud, on-premise, or hybrid, with servers in Spain or in the European sovereign cloud.

- High conversion: Optimized mobile interface, with an abandonment rate of < 8%.

How does the process work?

The main steps in the digital identity verification process are designed to ensure a secure, fast, and reliable experience. Below are the key stages of the verification flow that the user follows.

The user accesses the digital onboarding flow from the customer's website or mobile app.

- Capture the identity document (photo or NFC scan).

- Take a selfie with liveness detection.

- Tecalis Identity processes data in <30 seconds.

- The system returns a result with:

- Level of certainty (high, substantial, low).

- Risk and fraud indicators.

- Evidence of the process (images, logs, verification hash).

- The company decides to accept, reject, or escalate to manual review.

The entire process is auditable, traceable, and GDPR compliant, with the option to delete biometric data after verification. The average verification time is 22 seconds, and the success rate is 97.4%.

Benefits of online identity verification

Implementing a robust identity verification solution brings clear strategic advantages. The most notable are:

- Identity fraud prevention: drastically reduces the risk of impersonation, fake accounts, and illegal transactions. Up to 90% fewer impersonation attempts, based on real use cases.

- KYC/AML regulatory compliance: avoid millions in fines and protect your company's reputation.

- Process optimization: automate onboarding, reduce operating costs, and eliminate bottlenecks.

- Improved user experience: fast, simple, and mobile processes increase conversion and satisfaction.

- Digital sovereignty: by using European solutions such as Tecalis, you can be sure that your personal data will not leave the European Economic Area.

- Global scalability: with multi-jurisdictional support, you can operate in multiple countries without reinventing the process.