Index

Get the latest news right in your inbox

The digitalization of tax processes in Spain takes another step forward with the arrival of Verifactu, a new system for issuing verifiable invoices that will transform the way companies and freelancers manage their invoicing. Promoted by the State Tax Administration Agency in Spain (AEAT), this system is not only a new obligation, but a strategic tool in the fight against tax fraud and the underground economy. Its implementation, regulated by Royal Decree 1007/2023, marks a before and after in tax transparency and control.

This article is a complete and detailed guide to understand in depth what Verifactu is, how it works, who it affects and how to adapt your business to this new reality to ensure compliance and avoid penalties. We will analyze from the legal foundations of the Verifactu Regulation to the technical details of the "Verifiable Invoice Issuing System", including the crucial role of the QR code. If you are an entrepreneur or professional, this information is essential for the future of your business.

What is Verifactu and How Does it Affect Your Invoicing?

Verifactu is the name given to the system and format that regulates the requirements that invoicing software must comply with to guarantee the integrity, conservation, accessibility, legibility, traceability and unalterability of the records. In essence, these are systems that, at the moment of issuing a digital invoice, generate a computer record that can be sent securely and, in some cases, automatically to the AEAT.

The main objective of the Verifactu system is to put an end to the so-called "dual-use software", programs that allowed some companies to hide part of their sales and, therefore, evade taxes. With Verifactu, every invoice issued leaves a digital footprint that can be verified by the tax authorities.

This directly affects the daily operations of any business. It will no longer be enough to use just any invoicing program; it will be mandatory for this software to comply with the technical and legal standards defined in the regulations. The most visible change for the customer will be the inclusion of a QR code on all invoices, which will make it possible to verify their authenticity.

Verifactu Regulation: Anti-Fraud Law and Royal Decree 1007/2023

The legal basis for Verifactu is found in Law 11/2021, of July 9, on measures to prevent and combat tax fraud. This law amended article 29.2.j) of the General Tax Law, establishing the obligation for producers, marketers and users of invoicing systems and software to guarantee the principles of integrity, conservation, traceability and unalterability of the records.

To develop this legal provision, Royal Decree 1007/2023 of December 5 was published, a key document that details all the technical and functional specifications that invoicing software must comply with. It is also important to understand that the Ley Crea y Crece law of electronic invoice has also affected how we understand invoices today in Spain.

The regulation not only defines the characteristics of the software, but also establishes obligations for developers, who must submit a responsible statement ensuring that their programs comply with the regulations.

Objectives and Benefits of Verifactu System. How it Affects The AEAT, Taxpayers and Companies.

Although the implementation of a new system may seem like an administrative burden, Verifactu pursues clear objectives and brings benefits for both the Administration and the business community.

For the AEAT:

- Fight Against Tax Fraud: this is the primary objective. Having a real-time record of operations makes it difficult to hide income and manipulate accounting.

- Greater Control and Traceability: it allows the AEAT to follow the trail of commercial transactions more efficiently, facilitating inspection work.

- Automation and Efficiency: the standardization of billing record formats streamlines information processing and reduces the need for manual requirements.

- Improved Taxpayer Assistance: with the information available, the AEAT will be able to provide taxpayers with more complete and accurate draft returns, simplifying compliance with their tax obligations.

For Taxpayers and Companies:

- Simplification of Obligations: by submitting data to the AEAT, the preparation of VAT registration books and other tax forms will be facilitated, reducing the risk of errors.

- Legal Certainty: using a certified system guarantees compliance with current regulations, avoiding possible penalties and adapting to the new electronic invoice formats.

- Commercial Transparency: the verified invoice provides a greater guarantee of authenticity to customers. Anyone receiving an invoice can check its validity by scanning the QR code.

- Digitization and Modernization: it drives the adoption of advanced digital tools, resulting in improved efficiency and overall business productivity.

Fair Competition: by reducing the underground economy, it promotes a fairer market where all companies compete on a level playing field.

How Does Verifactu Work? The Technical Process of the Verifiable Invoice

Understanding how Verifactu works technically is key to understanding its scope. The process is based on the interaction between the business owner's invoicing software, cryptographic security and AEAT systems. The general flow is as follows:

- Invoice Creation: the user enters the transaction data into his Verifactu software.

- Generation of the Billing Record: when issuing the invoice, the system generates not only the document for the customer, but also a "discharge billing record". This record contains all invoice data in a standardized XML format. Similar to what we know as e-Invoice.

- Application of Security Measures: to guarantee unalterability and integrity, the software applies two key cryptographic mechanisms: Chaining of records, so that if the record is altered, the chain is broken, and Electronic signature, guaranteeing the authenticity of its origin.

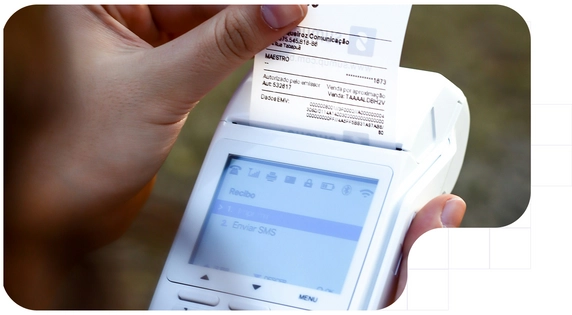

- Issuance of The Invoice to The Customer: the invoice delivered to the customer must include the QR code and, in some cases, the phrase "Invoice verifiable in the electronic headquarters of the AEAT" or "VERI*FACTU".

- Remission to The AEAT (optional): Verifactu systems allow the immediate sending of invoicing records to the AEAT electronic headquarters. If a company opts for this modality, its system will communicate directly with the Tax Authorities every time it issues an invoice, sending the signed XML record. Companies that do not opt for immediate sending must keep the records in full and secure in order to make them available to the AEAT when required.

There are free business solutions such as Tecalis Factura Electrónica that allow you to create invoices with this format and connect with the AEAT and the Verifactu system automatically and more easily than doing it from the AEAT website (which is complex and rough). You only need to upload your company digital certificate in Tecalis Sign and you will be able to create invoices with it through Tecalis Electronic Invoice.

Verifactu System Requirements: The "Verifiable Invoice Issuing System".

A software, in order to be considered a "Verifiable Invoice Issuing System" according to Royal Decree 1007/2023, must meet a series of very strict technical requirements. It is not just a matter of adding a QR; the architecture of the program must be designed to ensure the inviolability of the data.

The key elements are:

- Integrity and Inalterability: the system must guarantee by design that, once an invoice is issued, its record cannot be altered. Any subsequent modification (such as a cancellation or rectification) must generate a new record that refers to the original, always maintaining traceability.

- Traceability: it must be possible to follow the complete sequence of all invoices issued. This is achieved through the chaining of records, mentioned above.

- Electronic Signature: the system must be able to sign each invoice record with a qualified electronic certificate. This ensures that no one can repudiate the authorship of an invoice.

- Event Logging: the software must automatically log certain events, such as system startup, shutdown, user login or logout, or unauthorized modification attempts.

- Communication With the AEAT: for systems operating in the "Verifactu" mode (with data sending), the software must be able to establish a secure communication with the AEAT servers to send XML files in real time.

- QR Code Generation: the software must generate a QR code with a specific format and content.

QR in Verified Invoices: What Information Does it Contain? Its Importance for Invoice Traceability

The QR code is the most visible element of Verifactu and plays a fundamental role, being a gateway to invoice verification. By scanning it with a mobile device, the invoice recipient can instantly check its validity.

The information contained in the QR code is accurate and standardized:

- Issuer's VAT number.

- Invoice number and series.

- Date of issue.

- Total amount of the invoice.

- Billing system identifier.

- Technical data of the chained hash.

When a user scans the QR code, their device is redirected to a secure AEAT page. On this page, the Agency will confirm whether it has received a billing record that matches the QR data.

- If the company uses a Verifactu system with data remission: AEAT will be able to confirm that the invoice has been correctly declared. This can be automatically connected with applications such as Tecalis Sign and Tecalis Electronic Invoice.

- If the company uses a system that does not automatically remit data: AEAT will confirm that the QR data is consistent and technically valid according to the regulation, although it will not be able to confirm receipt.

The importance of this code is threefold:

- It Brings Confidence to The Recipient: it allows any customer to be sure that the invoice they have received is legal.

- It Facilitates Inspection: an inspector can scan several invoices at random and detect irregularities.

- It Encourages Social Control: it encourages consumers themselves to collaborate in the fight against fraud.

Implications of Entry Into Force : Who is Obliged and From When? Dates and Deadlines

The obligation to use software adapted to Verifactu extends to practically the entire business fabric in Spain. They are obliged:

- Corporate Income Tax taxpayers.

- IRPF Taxpayers who carry out economic activities (self-employed).

- Non-Resident Income Tax taxpayers who obtain income through a permanent establishment.

- Entities under the income attribution regime that carry out economic activities (such as communities of property or civil societies).

There are some exceptions, such as taxpayers under the Immediate Supply of Information (SII), since they already report their invoicing almost immediately to the AEAT. Certain sectors with special invoicing regimes, such as agriculture, livestock and fishing, are also exempt.

The implementation deadlines are a crucial aspect to take into account when planning the adaptation:

- Software Producers and Developers: they have a period of 9 months from the publication of the Ministerial Order developing the technical aspects of the Royal Decree to adapt their products. This order was published on April 2nd 2025.

- Companies and Professionals (end users): the obligation to use these adapted billing systems will come into force on January 1st 2027 for every company except freelancers that will be forced to adapt on July 1st 2027. As of that date, all invoices will have to be issued with software that meets the Verifactu requirements.

Penalties for Non-Compliance

Non-compliance with the Verifactu regulations carries with it a very severe penalty regime designed to deter any temptation to fraud. Penalties affect all parties involved:

- For Users (Companies and Freelancers): the use of invoicing programs that do not comply with what is specified in the regulation or that allow data manipulation will be considered a serious tax infringement. The penalty consists of a fixed pecuniary fine of €50,000 for each tax year in which the illegal software has been used.

For Software Producers and Marketers: the manufacture, production and marketing of software that allows to keep different accounting records, not to reflect all the operations or to alter transactions already recorded will be sanctioned with a fixed pecuniary fine of 150,000 Euros for each fiscal year in which sales have taken place and for each different type of system marketed.

How to Adapt to Verifactu: Software Solutions and Steps to Follow

Adapting to Verifactu is a process that must be approached in a planned manner. The management software market is already working at full capacity to offer adapted and certified solutions, such as Tecalis (Sign and e-Invoice).

Steps to follow for a correct adaptation:

- Audit of the Current System: analyze the invoicing software you are currently using. Contact your supplier and ask if their program will be compatible with the Verifactu Regulation. Ask them to confirm that they will issue the corresponding "responsible declaration" required by law.

- Research New Solutions: if your current software is not going to adapt or does not convince you, it is time to explore the market. Look for Verifactu software solutions that fit your business needs (cloud billing software, electronic signature and invoice software, etc.). Compare functionalities, prices and, above all, make sure they guarantee regulatory compliance. In Tecalis Sign and Tecalis Electronic Invoice you can connect with Verifactu through API or directly create invoices from its web platform.

- Migration Planning: changing invoicing software requires planning the migration of customer, product and historical invoice data. It is advisable to do this process with the help of the new vendor.

- Staff Training: the team in charge of invoicing must know how the new system works and understand the implications of Verifactu, such as the impossibility to delete or modify invoices already issued.

- Obtaining a Digital Certificate: the electronic signature is a pillar of Verifactu. Make sure you have a valid and operational digital certificate of a representative or natural person to be able to sign the billing records.

- Decide How to Communicate With The AEAT: you will have to decide whether your company will use the Verifactu system or simply use a software that meets the requirements but without the automatic sending. The first option, although voluntary, will simplify in the long run the relationship with the Tax Authorities and the fulfillment of tax obligations.

In short, Verifactu represents a paradigm shift in invoicing and tax management in Spain. It is a firm commitment to transparency, digitalization and tax justice. Adapting in time and with the right software solution is also an opportunity to modernize the administrative management of your business and compete in a more transparent and equitable market.