Index

Get the latest news right in your inbox

The digitization of financial services, the rise of fintech, global marketplaces, and the digital economy have made identity verification and regulatory compliance strategic pillars for any company operating online. In this context, KYC (Know Your Customer) software has established itself as a key tool for preventing fraud, complying with AML/KYC regulations, and providing secure and frictionless user experiences.

Today, choosing the best identity verification software is not just a matter of legal compliance, but a decision that directly impacts conversion, scalability, and customer trust. In this article, we take an in-depth look at what the KYC process is, why automated solutions are essential, what types of KYC solutions are available on the market, and what the key criteria are for choosing the right tool for your business.

What is the KYC process?

The KYC (Know Your Customer) process is a set of mandatory procedures used by financial institutions, fintechs, cryptoasset companies, and other regulated entities to verify the identity of their customers before, during, and after the start of a business relationship. Its main objective is to prevent fraud, money laundering (AML), terrorist financing, and other financial crimes.

This process includes, among other aspects:

- Identifying the customer using official documents.

- Verification of the authenticity of these documents.

- Biometric verification of the user.

- Analysis of sanctions lists, PEPs, and watchlists.

- Continuous assessment of customer risk.

In regulated sectors such as banking, fintech, insurance, crypto assets, online gaming, and telecommunications, KYC is not optional: it is a mandatory legal requirement. However, more and more unregulated companies are also implementing identity verification software to protect their platforms and users.

Why is KYC software necessary?

Regulatory complexity, the growth of digital fraud, and the need to offer fast onboarding processes have made manual KYC unfeasible in most cases. This is where KYC software comes in, automating, standardizing, and optimizing the entire verification process.

The evolution of KYC verification

Traditionally, KYC was done manually: reviewing physical documents, human checks, phone calls, and internal validations. This model presents multiple problems:

- High operating costs.

- Slow processes (days or weeks).

- High rate of human error.

- Poor user experience.

- Limited scalability.

With digitization came automated KYC solutions, capable of verifying identities in minutes or even seconds, using technologies such as OCR, facial biometrics, artificial intelligence, and machine learning.

Cost of manual KYC vs. ROI of automation

Various industry studies estimate that comparing the cost of manual KYC with the ROI of automation shows clear advantages in terms of operational efficiency, cost reduction, and regulatory compliance:

- A manual KYC process can cost between €30 and €150 per customer.

- Automated KYC reduces this cost by up to 70%.

- Automation improves onboarding conversion by up to 30-40%.

- It significantly reduces fraud and regulatory fines.

The return on investment (ROI) of implementing KYC software translates into lower costs, greater security, and a better customer experience.

Functions of an identity verification system

Modern identity verification software must cover multiple layers of control and compliance. The most relevant features include:

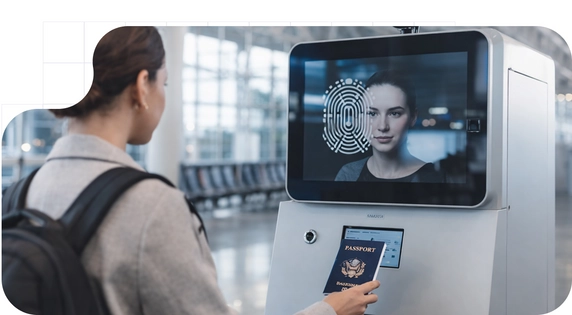

- Verification of identity documents: ID card, passport, driver's license, residence permits, etc.

- Data extraction and validation (OCR): Automatic reading of information and detection of tampering.

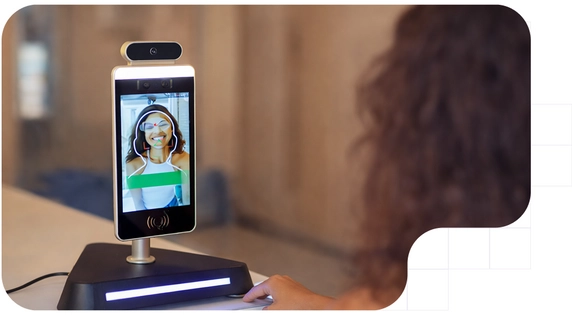

- Biometric verification: Facial comparison between document and user selfie/video.

- Liveness detection: Prevention of attacks using photos, videos, or deepfakes.

- AML screening: Checking against sanctions lists, PEPs, blacklists, and international watchlists.

- KYB (Know Your Business) modules to validate companies, beneficial owners, and shareholding structures.

- Risk management and scoring: Dynamic assessment of customer risk level.

- Auditing and traceability: Complete record for regulatory inspections.

- GDPR compliance and data protection: Secure management of sensitive information.

- Continuous monitoring of customers based on changes in their profile or suspicious activities.

These features are the basis of any competitive and scalable KYC software.

Key criteria for evaluating KYC software

Not all KYC solutions are the same. To make the right choice, it is essential to evaluate a series of key criteria that impact both compliance and daily business operations. Main criteria to consider:

- Advanced biometric verification: Facial recognition, passive and active liveness detection, resistance to deepfakes.

- Comprehensive AML/KYC regulatory compliance management: Coverage of local and international regulations, constant regulatory updates.

- Global document coverage: Ability to verify identities from multiple countries.

- Easy integration via API: Rapid implementation in apps, websites, and internal systems.

- Frictionless user experience: Fast, intuitive, and mobile-first onboarding.

- Scalability and performance: Ability to handle user spikes without losing accuracy.

- Accuracy and reduction of false positives: Key to not blocking legitimate customers.

- Support and customization: Adaptation to business flows and needs.

Good identity verification software must balance security, compliance, and user experience.

Types of KYC solutions on the market: Which one suits your business?

The market offers different types of KYC solutions, each geared toward specific needs. In general, we can classify them as follows:

- Basic KYC solutions: Focused on document verification and simple identity validation.

- KYC + AML platforms: Integrate identity verification with screening against sanctions lists and PEPs.

- Advanced biometric KYC solutions: With a strong focus on facial recognition, liveness, and anti-fraud.

- Digital onboarding platforms: Include KYC as part of a complete customer onboarding flow.

Choosing the right type of KYC will depend on the sector, user volume, applicable regulations, and risk level. The key is to identify the risk level of your business, the volume of customers to be verified monthly, and the jurisdictions in which you operate.

Tecalis: a unified platform that covers all types of KYC verification

In an ecosystem where tool fragmentation creates inefficiencies, Tecalis positions itself as a unified digital verification platform that goes beyond traditional KYC to cover the entire onboarding, authentication, and secure operation cycle.

Main modules and tools

- Identity Verification (KYC/KYB/AML) – Digital Onboarding: Combines advanced OCR, biometric verification with certified liveness detection, and automatic checks against more than 1,200 global lists (SEP, sanctions, restrictive lists). Supports more than 2,500 types of documents in more than 190 countries.

- Strong authentication and secure access: Implements MFA (Multi-Factor Authentication), SCA (Strong Customer Authentication according to PSD2), and behavioral biometrics for secure continuous sessions. Identity theft prevention.

- Extended capabilities: from KYC to digital closing: Unlike pure KYC providers, Tecalis integrates qualified electronic signature (eIDAS), time stamping, document custody, and GDPR consent management—all in a single flow. This allows, for example, a customer to register, verify their identity, sign a contract, and access their account, all in less than 3 minutes.

This approach allows companies to centralize all layers of digital trust on a single platform. Furthermore, this holistic vision not only complies with AML/KYC, but also turns compliance into a competitive advantage: higher conversion, lower abandonment, and greater user trust.

Key advantages of Tecalis KYC tools

Adopting Tecalis as a strategic KYC software provider allows organizations to radically transform their identity verification and risk management processes. The main benefits of using Tecalis as KYC software include:

- All-in-one approach: KYC, AML, biometrics, authentication, and digital signature in a single solution.

- Advanced technology: Artificial intelligence, machine learning, and state-of-the-art biometrics. Proprietary facial recognition algorithms with >99.5% accuracy and a false positive rate <0.3%.

- Global regulatory compliance: Adaptation to international and local regulations (eIDAS, GDPR, PSD2, AML6 certifications).

- Excellent user experience: Fast, intuitive, and frictionless onboarding.

- Flexibility and customization: Configurable flows according to sector and risk.

High accuracy and security: Reduction of fraud and false positives.

Recommended use cases based on company size or sector

The use cases for KYC software depend on the sector and size of the company, as each industry has different levels of risk, identity verification requirements, and AML/KYC compliance obligations. The main ones are:

- Fintech and digital banking: remote onboarding, strict AML/KYC compliance.

- Cryptoasset and Web3 companies: robust verification and fraud prevention. They must comply with emerging regulations (MiCA in the EU).

- Insurance and telecommunications companies: digital customer onboarding and identity validation. They require light but secure verification.

- Marketplaces: buyer and seller verification.

- Enterprise companies: mass identity and access management

- Public administration and digital services: use the platform for sovereign digital identity, access to public services, and signing documents.

How to choose the ideal KYC solution for your business

Choosing the right KYC software requires strategic analysis. It's not just about complying with the law, but about finding a solution that aligns with your business objectives.

Practical decision-making guide

Selecting the right provider requires strategic analysis that aligns technical capabilities with your organization's growth objectives. To facilitate this process, it is necessary to consider the following fundamental criteria before making a decision:

- Analyze your risk level and regulatory sector: Do you operate in high-risk sectors such as crypto, payments, or banking? Then you need EDD and dynamic monitoring.

- Define your user volume and target countries: If you verify >10,000 customers/month, look for solutions with scalable rates and high availability (SLA >99.9%).

- Evaluate geographic coverage: If you serve customers in Latin America, make sure the software recognizes ID cards from Ecuador, Mexico, Colombia, etc.

- Prioritize the desired user experience: Conduct real tests with end users. Good KYC should not feel like a "formality," but rather a layer of trust.

- Prioritize scalability and automation: Choose KYC software that can grow with your business and automate identity verification without compromising accuracy or user experience.

- Consider the total cost of ownership (TCO): Analyze the overall cost of the solution, including licenses, integrations, support, maintenance, and long-term regulatory compliance.

Key questions to ask before deciding on a provider

Before selecting a KYC software provider, it is essential to analyze a series of strategic questions that will allow you to align the identity verification solution with your operational, regulatory, and business growth needs. Some of these questions are:

- What is my budget per verification?

- What volume of verifications do I expect monthly?

- What specific regulations must I comply with?

- Do I operate in sectors subject to specific regulations?

- How many users do I verify per month?

- Do I need KYC, KYB, or both?

- What level of biometrics do I require?

- Does the solution integrate easily with my systems?

Answering these questions makes it easier to make the right choice.

Future trends in KYC solutions

The future of AML KYC compliance is marked by technological innovation and regulatory evolution. Main trends:

- Predictive artificial intelligence: systems will not only verify identities, but also predict risky behavior by analyzing transactional and digital patterns.

- Greater use of multimodal biometrics: combination of facial, voice, and behavioral (typing, scrolling) recognition for continuous authentication.

- Sovereign Digital Identity (SSI): users will have full control over their data through digital wallets (such as those proposed in the European EUDI Wallet framework). Companies will not store data, but will verify verifiable credentials issued by trusted entities.

- Regulatory interoperability: progress will be made towards global KYC standards (such as the model proposed by the Global Legal Entity Identifier Foundation).

- Real-time and collaborative KYC: platforms will share (with consent) verified data between entities, reducing process repetition (shared KYC).

These innovations transform KYC from a mandatory cost into a strategic lever: it improves customer trust, reduces fraud, and accelerates digital transformation.

Conclusion

Investing in good KYC software is no longer just a regulatory obligation. It is a strategic investment in security, operational efficiency, and customer trust. Companies that are committed to advanced identity verification, biometric verification, and regulatory compliance management solutions are better prepared to compete in an increasingly demanding digital environment.

A comprehensive approach, such as that offered by unified platforms like Tecalis, allows KYC to be transformed from a simple legal requirement into a real competitive advantage.