Index

Get the latest news right in your inbox

Digitalization, changing customer expectations and new regulations are transforming the banking and financial sector. Events such as Revolution Banking have become key platforms to discuss and showcase the trends shaping the future of this sector. Revolution Banking 2025 highlighted the increasingly important role of advanced technology solutions designed to improve both customer experience and operational efficiency.

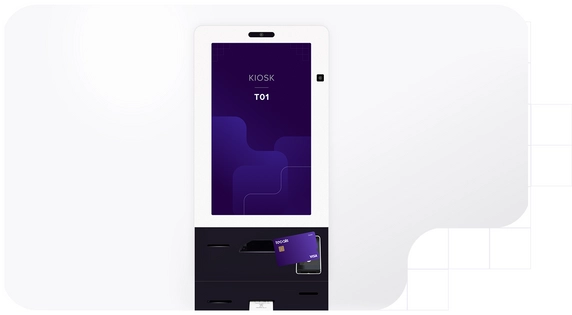

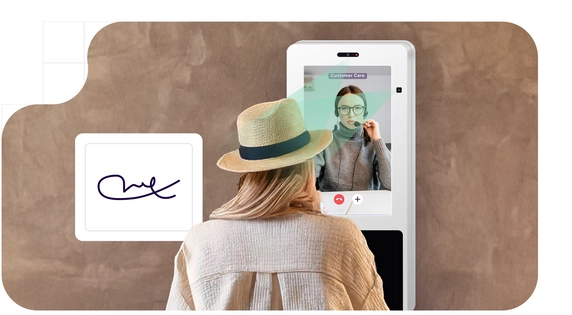

In this edition, Tecalis presented its innovative inter-active kiosk designed to issue bank cards (credit and debit) in a fully automated, secure and instantaneous way. In addition, it demonstrated how this technology is integrated within a complete ecosystem of solutions designed for the banking and financial sector. This includes various RegTech tools for compliance automation (KYC, AML), frictionless digital onboarding platforms and advanced e-signature solutions.

Inter-active kiosks for banking: what can they offer?

Inter-active kiosks or inter-active kiosks will become a key player in the financial ecosystem as they continue to provide innovative solutions that facilitate traditional processes and open up new business opportunities. Among the most prominent functionalities and use cases are:

- Instant issuance of cards and KYC verification.

One of the most revolutionary applications of these kiosks is the ability to dispense credit and debit cards activated instantly after a KYC verification process.

- Integrated KYC process: Thanks to facial recognition technology and automated document verification, the kiosk can identify the user within minutes, reducing friction and speeding up onboarding.

- Real-time activation: Once the process is completed, the issuance and activation of the card is done immediately, which means that the customer can start using their financial services without long waits.

- Comprehensive digital identity management

In addition to KYC verification, these kiosks incorporate advanced systems for identity control, allowing:

- Registration and authentication: The kiosk collects biometric data and other authentication elements that are integrated into the bank's database, facilitating continuous monitoring and fraud prevention.

- Integration with CRM/BSS: The information collected is automatically integrated into management systems, allowing constant updating of customer profiles.

- Interaction and omnichannel experience

Inter-active kiosks are redefining the way customers interact with banking services, taking them beyond the traditional branch and offering concrete solutions in strategic locations. Their intuitive design and automation capabilities open up a range of practical applications:

- Services at high-traffic points: Imagine taking out last-minute travel insurance directly from a kiosk at the airport before boarding, or opening a bank account quickly and easily while in a shopping mall, without having to visit a branch office. These kiosks offer immediate convenience where customers need it most.

- Advanced branch complement: Within the branches themselves, kiosks act as a complement to automated teller machines (ATMs). While ATMs focus on withdrawals and deposits, kiosks can handle more complex tasks such as advanced identity verification, applying for specific financial products like loans, updating personal data or instant card issuance, freeing staff for higher-value advice.

- New financial horizons: Kiosks are also positioning themselves as access points to emerging financial services. For example, they facilitate the buying and selling of cryptocurrencies in a secure and regulated manner, bringing these digital assets to a wider audience in a trusted physical environment.

- Extended Inter-active operations: Beyond these examples, kiosks can handle bill payments, make complex transfers, offer personalized recommendations based on the customer's profile, or facilitate the management of procedures that previously required personal assistance.

In short, Tecalis' inter-active kiosks are not only a technological improvement, but a strategic tool that allows financial institutions to deploy specific services (from insurance and accounts to crypto) in an agile, secure and customized way in multiple locations, optimizing operations and improving the experience in the digital era.

Beyond the usual banking product: Inter-active kiosks for diversification

The true potential of the inter-active kiosk or self service kiosk in the banking sector lies in its ability to transcend the boundaries of the traditional branch and the purely financial product catalog. Its flexibility of location and the breadth of functionalities it can integrate make it an ideal platform for the diversification of services and the expansion of brand presence to new environments. Among the most relevant aspects, the following stand out:

Presence at multiple points of contact

The kiosk is not limited to bank branches; its versatility allows it to be implemented in:

- Airports and train stations: Ideal for travelers requiring quick access to banking services, such as card issuance or currency management.

- Shopping malls: Kiosks can offer services such as account opening, insurance sales and bill payments, taking advantage of the high flow of people.

- Universities and study centers: Facilitate access to financial services for students and young entrepreneurs, promoting financial inclusion.

- Offering of complementary services

In addition to traditional banking products, in the future these kiosks could enable the activation of other services that expand the bank's offerings:

- Insurance and protection: Possibility of taking out personalized insurance (health, life, home) instantly.

- Ticketing and entertainment services: Integration of solutions for the purchase of tickets for events, movies or shows, taking advantage of the convenience of Inter-active.

- Bill payment and invoicing: They allow you to manage the payment of utilities and other bills, centralizing multiple operations in a single terminal.

- Expansion of the digital channel network

The use of kiosks in non-traditional spaces allows financial institutions:

- Reach new customer segments: Especially those who do not have easy access to physical branches or prefer non-conventional channels.

- Improve brand visibility: By being present in strategic locations, institutions can reinforce their image and position themselves as innovative and customer-oriented.

This diversification not only improves customer experience and reduces operating costs, but also opens up new lines of business and monetization opportunities, enabling banks to adapt to changes in consumer behavior and the digital environment.

Banking, finance and insurance industry news 2025

The banking industry is a dynamic ecosystem, driven by technological innovation, changing consumer demands and a constantly evolving regulatory framework. Anticipating and adapting to industry developments is crucial to remain competitive. Events such as Revolution Banking 2025 serve as a thermometer to identify the key trends that will define the near future. Some of the most relevant areas that are setting the agenda for 2025 and the years to come include:

- Regulation and compliance in the digital age

The evolution of regulations, both at European and global level, is aimed at reinforcing security and transparency in financial transactions:

- New directives and regulations: Regulations such as PSD3 come into force and new updates to the AML/KYC guidelines are expected to, which will require more agile and secure verification processes.

- Greater emphasis on consumer protection: The implementation of measures to ensure data privacy and security, such as the adoption of electronic signature solutions and biometric verification systems, will be essential to comply with regulatory requirements.

- Technological advances and integration of digital solutions

Automation and the use of emerging technologies will mark a turning point in service delivery:

- Process automation: The use of artificial intelligence, machine learning and data analysis algorithms will facilitate the automation of KYC/KYB/AML processes, significantly reducing verification times and improving operational efficiency.

- Integration with ERP and CRM systems: Inter-active kiosk solutions will be seamlessly integrated with internal management platforms (BSS/CRM), enabling real-time updating of customer information and proactive response to changes in risk profile.

- Innovation in the user experience: Technologies such as facial recognition, OCR (Optical Character Recognition) and advanced electronic signature will combine to offer frictionless onboarding and verification processes, raising the level of customer satisfaction.

- Trends in open banking and open finance

The movement toward greater openness of financial data will continue to gain momentum:

- Open Banking extended to Open Finance: The opening of banking data will not be limited to payment services, but will be extended to insurance, investments and other financial products, generating a more integrated and competitive ecosystem.

- Interoperability and collaboration between fintech and banks: Strategic alliances between traditional entities and fintech startups will enable the development of new products and services, optimizing the offer for customers and opening up opportunities for disruptive innovation.

Tecalis is aligned with these trends by offering solutions that directly address these challenges. Its identity verification and digital onboarding platforms, which can be integrated into interactive kiosks or used in online/mobile channels, respond to the need for efficient and secure KYC/AML processes, compatible with eIDAS. In addition, Tecalis Sign facilitates digital onboarding, and its customer hub can help in personalization and risk management.

Automation of KYC/KYB/AML and digital sourcing processes

Efficiency and accuracy in identity verification and digital contracting are fundamental pillars of modern, secure banking. Technological advances enable the automation of processes that have historically been slow and costly. Let's take a look at how these processes are being transformed:

- Simplification of processes through technology

- Automated verification: The implementation of facial recognition systems, OCR and artificial intelligence algorithms makes it possible to identify and verify the identity of customers in real time, reducing manual intervention and minimizing errors.

- Customized risk assessment: With data analysis tools, it is possible to create dynamic risk profiles that are automatically updated as new information is gathered. This is crucial for implementing due diligence and ongoing monitoring processes in compliance with AML/KYC regulations.

- Integration with management platforms

Automation solutions do not act in isolation. They are integrated with internal management systems, allowing:

- Data synchronization: Information captured at kiosks is immediately transferred to CRM/BSS systems, improving traceability and efficiency in customer service.

- Intelligent workflows: Automation allows you to set up adaptive workflows that, based on the customer's profile, can request additional information, forward cases to review teams, or trigger notifications for follow-up.

- Digital contracting and electronic signature

The digital procurement process benefits greatly from the integration of electronic signature solutions:

- Advanced and qualified electronic signature: These solutions provide the necessary legal security for digital contracts to have the same legal value as those signed on paper.

- Time reduction: The incorporation and signing of documents can be done in minutes, which speeds up the closing of business and improves the customer's experience.

Advanced technological solutions, such as those developed by Tecalis in the RegTech field, not only incorporate these automation capabilities, but also ensure that the verified information and data collected during these processes (either through an inter-active kiosk, web or app) are seamlessly and securely integrated directly into the financial institution's core systems (CRM, Core Banking, Risk Systems - BSS). This end-to-end integration is key to maximizing efficiency, reducing errors and having a single, up-to-date view of the customer, facilitating ongoing regulatory compliance and more informed decision making.

New regulations in the European framework that will soon affect the banking sector

The regulatory environment for the banking and financial sector in Europe is one of the most dynamic and demanding in the world. Institutions must be constantly alert to legislative developments that seek to increase security, transparency, consumer protection and system stability. Several recent or developing initiatives will have a significant impact on banking operations in 2025 and beyond:

- The eIDAS 2.0 regulation introduces the European Digital Identity Wallet (EDIW) to simplify KYC processes in cross-platform onboarding across the EU. Banks will have to adapt their systems to accept and verify these digital identities and signatures.

- The EU is strengthening its AML/CFT framework with a single regulation that includes rules on customer due diligence processes, beneficial ownership and limits on cash payments.

- The Sixth Anti-Money Laundering Directive (AMLD6) complements the regulation by specifying aspects that require transposition into domestic law.

- A new EU agency (AMLA) was created with supervisory powers over high-risk financial institutions and coordinating national FIUs.

- New regulations for cryptoassets force banks to invest in more robust anti-money laundering (AML) systems and to adapt to supervision by the Financial Services and Markets Authority (AMLA).

- The DORA Regulation, already in force, establishes uniform security requirements for financial institutions and their ICT providers. It involves investments in cybersecurity and business continuity, obliging banks to manage ICT risks, perform resilience testing and report serious incidents.

- The Markets in Cryptoassets Regulation (MiCA) establishes a common regulatory framework for cryptoassets and related service providers in the European Union. It provides legal certainty and establishes authorization and operating requirements, investor protection rules and specific rules for stablecoins. Banks offering services related to cryptoassets will have to comply with MiCA and AML/CFT regulations.