Index

Get the latest news right in your inbox

The cryptocurrency sector has experienced exponential growth in the last decade, attracting both individual investors and financial institutions. In this context, the KYC process in crypto has acquired a fundamental relevance in customer registration, becoming a pillar for its regulation, security and legitimization of the sector.

This requirement, which initially seemed to contradict the decentralization and privacy principles of cryptocurrencies, has become an indispensable element for exchange platforms, digital wallets and any service that facilitates transactions with digital assets.

Implementing a robust cryptocurrency KYC process not only helps your business comply with the law and avoid hefty fines, but also protects your users, ensures the integrity of your operations and fosters greater trust in the crypto market as a whole.

How KYC processes work in the cryptocurrency industry

KYC processes in crypto, especially in centralized exchanges (CEX) and other platforms that facilitate the purchase, sale or exchange of digital assets for legal tender, follow a structure similar to that of traditional banking, although adapted to the digital environment. The objective is to establish with a reasonable degree of certainty that a customer is who they say they are.

Generally, the process is initiated during the user's registration or onboarding on a platform and usually consists of the following steps:

1. Customer Information Collection (CIP - Customer Identification Program)

- Basic Information: Full name, date of birth, residence address, nationality and, in some cases, tax identification number. This is known as KYC Form.

- Identity Documentation: The user is required to upload a scanned copy or high quality photograph of an official government-issued identity document. Commonly accepted documents include passport, DNI (Documento Nacional de Identidad) or driver's license.

- Proof of Address: Some platforms, especially for higher verification levels or for users from certain jurisdictions, may require a recent document (usually less than 3 months old) verifying the user's residential address. This can be a utility bill (water, electricity, gas), a bank statement or an official government letter.

- Documentary Verification: The platform analyzes the authenticity of the documents submitted, checking watermarks, holograms (if visible in the image), typography, and the consistency of data. Automated tools and sometimes manual review are used.

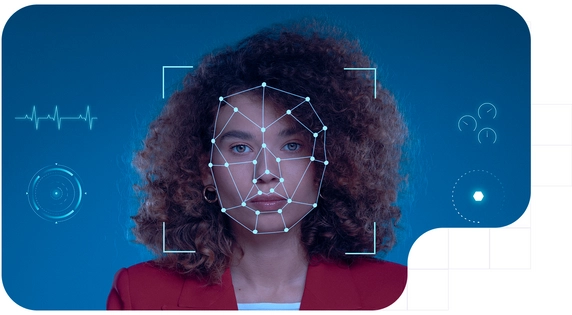

- Biometric Verification (Proof of Life or Liveness Check): To prevent identity theft through the use of photos of stolen documents, some platforms such as Tecalis Identity implement a proof of life. This often involves the user taking a real-time selfie, sometimes performing specific actions such as blinking, smiling or turning their head, to prove that they are a real, present at the time of verification. Some technologies compare this selfie to their ID photo.

- Video Verification: In higher risk cases or for certain services, a short video call with a platform agent may be required to confirm the user's identity in real time.

3. Customer Due Diligence

- Risk Assessment: The platforms assign a risk level to each client based on the information provided, their geographic location, the type of transactions they intend to perform and their volume.

- Cross-referencing with Sanctions Lists and PEPs: Customer data is cross-referenced with global databases that include international sanctions lists (such as UN, OFAC, EU), politically exposed persons (PEPs) and watch lists related to criminal activities. This helps identify whether the customer is involved in illicit activities or represents a high risk.

4. EDD - Enhanced Due Diligence

For clients identified as high risk (e.g. PEPs, individuals from high-risk jurisdictions or those conducting high-volume transactions), more comprehensive verification measures are applied. This may include requesting information on the source of funds (SoF - Source of Funds) or source of wealth (SoW - Source of Wealth), as well as more detailed scrutiny of their transactional activities.

5. Continuous Monitoring

KYC is not a one-time process. Platforms must continuously monitor their customers' transactions for suspicious or unusual patterns that may indicate money laundering or other illicit activities. This can lead to additional requests for information or even account blocking if fraudulent activity is confirmed.

The implementation of KYC processes in the cryptocurrency industry has several key objectives:

- Prevention of money laundering (AML): By verifying the identity of users, the use of platforms for illicit activities, such as money laundering, becomes more difficult.

- Regulatory compliance: Financial regulations in many jurisdictions require cryptocurrency platforms to implement KYC measures to operate legally.

- User security: By confirming the identity of users, the risk of fraud and identity theft is reduced.

These processes, while they may vary slightly across platforms, are at the core of cryptocurrency KYC processes. Their implementation seeks to balance the need for security and compliance with user experience, a constant challenge in the industry.

Why is KYC important when working with cryptocurrencies?

Cryptocurrency KYC processes benefit all players in the sector, from individual users to the industry as a whole, and are crucial for user protection and the security of their funds on crypto-asset platforms. By verifying identity, identity theft and unauthorized access are prevented, allowing legitimate account holders to recover their accounts.

It also makes fraud more difficult by preventing fraudsters from operating under false identities. Platforms with robust KYC processes are committed to overall security under a regulatory framework and the identification of parties is vital in case of disputes or suspicious activity.

Together with anti-fraud controls and AML/CFT compliance, it combats money laundering and terrorist financing by linking transactions to real identities. This makes anonymity more difficult and allows illicit funds to be traced, which is crucial for platforms and authorities to detect suspicious activity and transaction patterns indicative of financial crime.

KYC processes in the cryptocurrency industry, although they add steps to digital onboarding, are fundamental to ensure its security. They allow a relationship of trust to be established with the user, who feels more secure knowing that the platform rigorously verifies identities, and ensures regulatory compliance from the outset.

These processes are essential to foster the legitimacy and mass adoption of cryptocurrencies. These processes generate greater confidence in institutional investors and large corporations by signaling regulatory maturity and seriousness in the sector. In addition, adopting robust KYC processes facilitates constructive dialogue with regulators, which can lead to clearer and more favorable regulatory frameworks, and is crucial for smooth integration with the traditional financial system by complying with its regulatory standards.

In summary, while cryptocurrency KYC processes may introduce additional steps in onboarding, their role is vital to protect users, combat financial crime and build a safer and more legitimate cryptoasset ecosystem in the long term. Solutions like Tecalis Identity are critical for companies to meet these regulatory imperatives, strengthening the trust and security of the ecosystem.

KYC in cryptocurrencies and crypto exchanges

While the need for KYC processes in cryptocurrency acquisition and crypto exchange registrations is increasingly accepted to combat illicit activities, prevent fraud and comply with regulations, their implementation is not without significant challenges and controversies. These issues range from technical and operational difficulties to philosophical clashes with the founding principles of cryptocurrencies.

The implementation of KYC processes in cryptocurrencies contradicts the founding principles of decentralization and privacy, and is seen by many as an ideological betrayal that reintroduces surveillance and centralized control, eroding anonymity. This philosophical conflict persists in the crypto community.

Fake IDs and deepfakes are growing threats to cryptocurrency KYC controls. These deepfakes, generated with artificial intelligence, are sometimes able to bypass biometric verification and proof of life, facilitating the creation of fraudulent accounts.

Failure to comply with KYC/AML procedures in the cryptocurrency market carries regulatory risks, including heavy fines, revocation of licenses and the criminal prosecution of managers.

Privacy-focused cryptocurrencies such as Monero, Zcash and Dash offer anonymity, attracting privacy-seeking users while also concerning regulators because of their potential illicit use and lack of KYC controls. Many exchanges have stopped offering these coins to avoid regulatory issues.

Cryptocurrency KYC regulatory framework: Key regulations (eIDAS, MiCA, FATF...)

The regulatory environment governing KYC processes in the cryptocurrency industry has undergone an accelerated evolution in recent years, moving from an almost absolute legal vacuum to an increasingly defined and demanding framework. This regulatory development reflects the growing importance of digital assets in the global financial system and the concern of regulators to ensure their legitimate use. Some of the most influential regulations and standards include eIDAS, MiCA and recommendations from the FATF.

eIDAS (electronic IDentification, Authentication and trust Services)

The European Union's eIDAS regulation, although not specifically designed for cryptocurrencies, is crucial in digital identity verification, establishing a framework for electronic identification and trust services in the EU. It provides standards for digital identification in cryptocurrency customer onboarding processes and seeks to increase the security and interoperability of digital identities to function effectively between different countries. The future revision, eIDAS 2.0, will introduce the European Digital Identity Wallet (EUDI Wallet), which could transform the way cryptocurrency KYC processes are conducted.

MiCA (Markets in Crypto-Assets)

The Markets in Cryptoassets Regulation (MiCA) is designed to create a joint regulatory framework for cryptoassets and related service providers (CASPs) within the EU. The MiCA regulation, which will be progressively implemented, imposes strict requirements on CASPs, including the obligation to obtain licenses, maintain sufficient capital, protect client funds and, crucially, to implement AML and KYC procedures in the cryptocurrency industry. Under this regulation, service providers will be required to:

- Identify and verify the identity of their customers.

- Apply customer due diligence measures.

- Monitor transactions for suspicious activity.

- Comply with the FATF "Travel Rule" for cryptoasset transfers.

This regulation seeks to increase transparency, reduce fraud, investor protection and market integrity, and is expected to have a significant impact on how cryptocurrency platforms in Europe and those serving European customers operate.

FATF/GAFI Recommendations and Standards

The Financial Action Task Force (FATF) has taken a central role in establishing global standards for cryptocurrency KYC processes:

1. FATF Recommendations Update: In 2018, the FATF updated its 40 Recommendations to explicitly include virtual asset service providers (VASPs), stating that they should be subject to the same AML/CFT obligations as traditional financial institutions.

2. Definition of KYC standards: FATF Recommendation 10 establishes minimum due diligence requirements for clients that VASPs should apply, including:

- Identification and verification of customer identity

- Identification of the final beneficiary

- Understanding the nature of the business relationship

- Continuous monitoring of the relationship and transactions

3. Travel Rule: FATF Recommendation 16, known as the "Travel Rule," requires VASPs to collect and transmit originator and beneficiary information on cryptoasset transfers, setting a standard that has been adopted by key jurisdictions such as the United States, the European Union and Singapore.

4. Mutual evaluations: The FATF periodically evaluates member countries' compliance with its recommendations, which has led many jurisdictions to strengthen their KYC requirements for cryptocurrencies for fear of receiving negative evaluations that could affect their international financial relations.

5. Updated guidance for virtual assets: The FATF's 2021 guidance on virtual assets provides detailed clarifications on how AML/CFT standards, including KYC requirements, should be applied to the cryptocurrency ecosystem.

EU AML Directives (AMLDs)

The 5th Anti-Money Laundering Directive (AMLD5) already brought virtual currency to fiat currency exchange service providers and e-wallet custodian service providers under the scope of EU AML/CFT regulations, obliging them to apply KYC. The AMLD6 strengthened certain provisions, and work is underway on a new EU AML package that will include an AML Authority (AMLA) and more detailed regulations.

National Laws

Each country is also developing or adapting its own laws. For example, in Spain, Law 10/2010 on the prevention of money laundering and terrorist financing, and its regulatory developments, establish KYC/AML obligations for obligated parties, including cryptocurrency service providers.

Bank Secrecy Act (BSA) and FinCEN (U.S.)

In the United States, the Bank Secrecy Act (BSA) requires financial institutions to prevent money laundering. The Financial Crimes Enforcement Network (FinCEN) has issued guidelines classifying certain cryptocurrency businesses as money transmitters, subject to registration, KYC and AML requirements.

Cryptocurrency KYC verification levels: What information is requested at each level?

Exchanges and platforms typically set various levels of KYC verification for registering or trading cryptocurrencies, each with specific requirements and limits:

- Level 1 (Basic): Requests minimal information such as name, e-mail and country of residence. This level allows trading with low limits and, in some cases, without the need for additional documentation.

- Level 2 (Intermediate): Requires presentation of official documents (ID card, passport, driver's license) and sometimes proof of address. Deposit and withdrawal limits increase considerably.

- Level 3 (Advanced): Includes biometric verification (selfie, facial recognition), source of funds declaration and, for institutional users, corporate documentation. Allows operating with high volumes and access to advanced services.

The KYC process may include digital forms, document uploads, real-time validation and, in high-risk cases, interviews or manual reviews by exchange staff.

Another verification method is KYC forms, which collect personal, financial and economic activity data from customers to comply with regulations. They are essential in the BFSI sector (Banking, Financial Services and Insurance), and are used in onboarding and for periodic updates, and can result in account blocking if the required information is not provided.

Protection of personal data in cryptocurrency KYC processes

The collection of large amounts of personally identifiable information (PII) during cryptocurrency KYC processes raises important data protection issues. Cryptocurrency platforms implementing KYC become custodians of extremely sensitive data, forcing them to adopt robust measures to ensure their security and comply with privacy regulations, with the European Union's General Data Protection Regulation (GDPR) being one of the most influential frameworks globally.

The GDPR sets out key principles for the processing of personal data that cryptocurrency platforms must observe:

- Lawfulness, fairness and transparency: Platforms must clearly inform users what data is collected, for what purposes (KYC/AML), how long it will be retained and what their rights are. Consent must be explicit for uses beyond strict legal compliance.

- Purpose limitation: Data collected for KYC should only be used for that specific purpose (identity verification, fraud prevention, AML compliance) and not for other purposes (such as non-consensual marketing) without additional permission.

- Data Minimization: Only data strictly necessary to comply with KYC requirements should be collected. For example, if a basic level of verification only requires name and ID, proof of address should not be requested unless the user opts for a higher level or the regulation requires it for that level.

- Accuracy: Platforms must take reasonable steps to ensure that personal data is accurate and kept up to date. They must provide users with mechanisms to correct their information.

- Storage Limitation: Personal data should not be retained longer than necessary for the purposes for which it was collected. AML regulations often require the retention of KYC data for a specified period (e.g. 5 years) after the end of the customer relationship. After this time, the data must be securely deleted or anonymized.

- Integrity, confidentiality and security: This is a critical aspect. Platforms must implement robust technical and organizational measures to protect KYC process data against unauthorized access, loss, destruction or damage. These include:

- Encryption: Both in transit (when data is sent over the Internet) and at rest (when stored on servers).

- Strict access controls: Limit who within the organization can access KYC process data, based on the need-to-know principle.

- Security audits and penetration testing: To identify and correct vulnerabilities.

- Incident response plans: To effectively manage any data security breach.

- Proactive Accountability: Platforms must be able to demonstrate their compliance with the GDPR. This involves keeping records of data processing activities, conducting data protection impact assessments (DPIAs) for high-risk processes, and, in some cases, appointing a Data Protection Officer (DPO).

Protecting personal data collected during cryptocurrency KYC is not only a legal obligation, but also a crucial factor in maintaining user trust. A security breach that exposes your customers' KYC data can have financial and reputational consequences for the platform, as well as for the affected individuals.

Reducing the friction of KYC processes in cryptocurrencies

One of the biggest challenges to user adoption and retention on cryptocurrency platforms is the friction inherent in KYC processes. Procedures that are lengthy, confusing, require multiple attempts or are perceived as invasive can frustrate users to the point that they abandon the onboarding process altogether. Reducing this friction, without compromising security or regulatory compliance, is crucial to improving user experience and conversion rates.

Tools such as Tecalis Identity and Tecalis Sign reduce friction in onboarding by integrating the entire verification flow into a single platform, complying with the most demanding regulations and minimizing the time and effort required by the user. The combination of these solutions offers:

- Fast digital onboarding: Allows the KYC process to be completed in minutes, with automatic document validation and biometrics.

- Guaranteed regulatory compliance: Adapts to local and international regulations, updated in the event of any legislative change.

- Optimized user experience: Offers intuitive interfaces, multilingual support and real-time assistance to resolve issues.

- Fraud prevention: They incorporate deepfake detection systems, behavioral analysis and cross validation to prevent impersonation and unauthorized access.

- Electronic signature and document management: Facilitates contract signing and secure document management in the same onboarding flow.

Adopting solutions such as those from Tecalis not only reduces friction and churn, but also improves the security, scalability and reputation of cryptocurrency-related platforms.